The psychology behind large forex drawdowns is very easy to understand.

DRAWDOWN FUNDS PRO

Novice traders and pro traders are still prone to experience large drawdowns in their trading accounts.

DRAWDOWN FUNDS FREE

Make sure you hit the subscribe button, so you get your Free Trading Strategy every week directly into your email box. If this is your first time on our website, our team at Trading Strategy Guides welcomes you. Our team of industry experts at TSG developed this guide to explain the meaning of drawdown in trading to help you recover from drawdowns.

DRAWDOWN FUNDS HOW TO

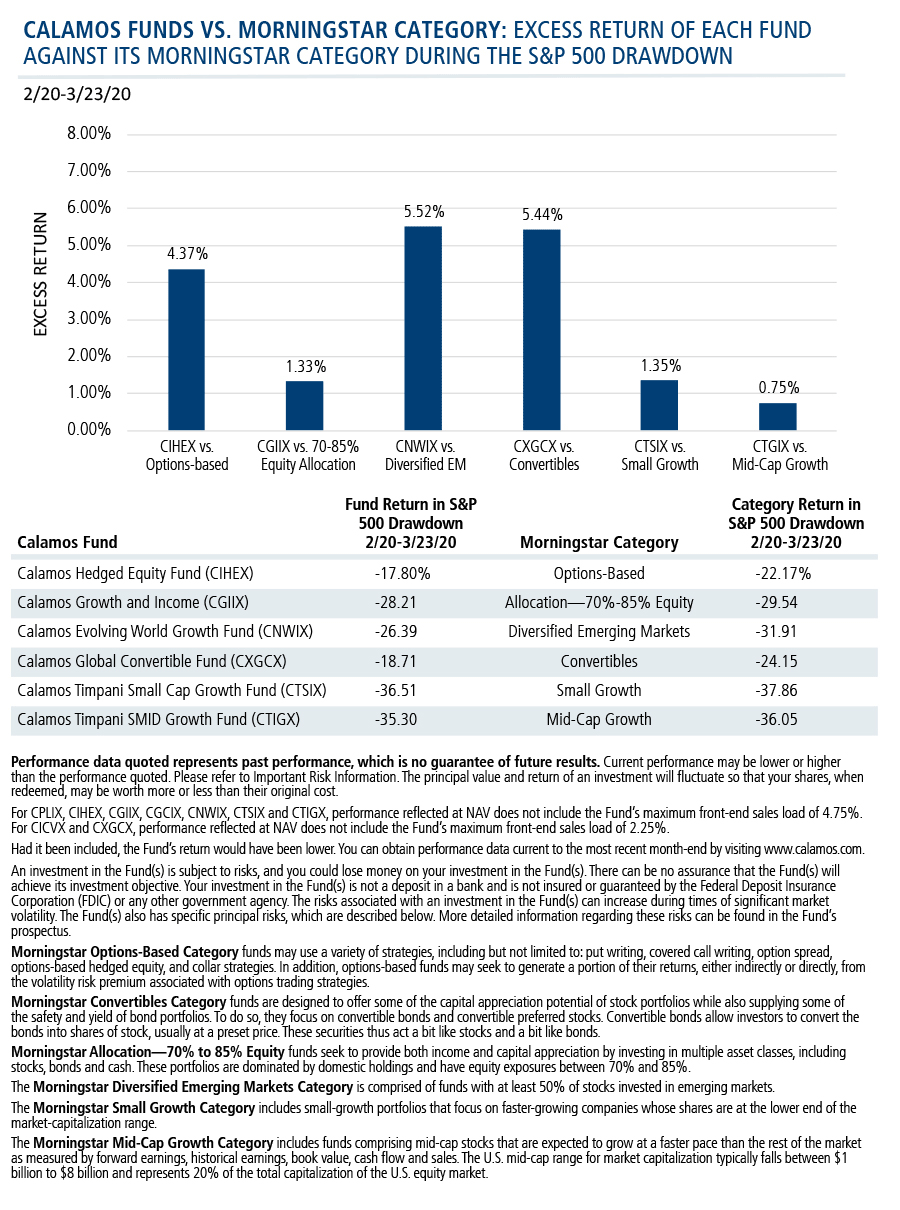

If you don’t know how to control drawdown in forex trading you can lose your entire balance. The personal data collected by Calamos on this website, or by any other means, is collected and stored in accordance with the General Data Protection Regulation (EU) 2016/679 ("GDPR").Learning how to manage drawdown trading in Forex is more important than the bottom-line profits. Calamos®, Calamos Investments® and Investment strategies for your serious money® are registered trademarks of Calamos Investments LLC.Ĭalamos Investments LLC, referred to herein as Calamos Investments®, is a financial services company offering such services through its subsidiaries: Calamos Advisors LLC, Calamos Wealth Management LLC and Calamos Financial Services LLC. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-80.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEEĬalamos Financial Services LLC, DistributorĬheck the background of the firm and its investment professionals on FINRA's BrokerCheck.īefore investing, carefully consider the fund's investment objectives, risks, charges and expenses.

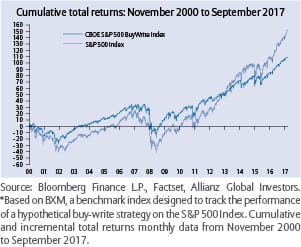

Indexes are unmanaged, do not entail fees or expenses and are not available for direct investment.īefore investing carefully consider the fund’s investment objectives, risks, charges and expenses. The S&P 500 Index is considered generally representative of the U.S. Information contained herein is for informational purposes only and should not be considered investment advice.Ī drawdown is the peak-to-trough decline during a specific record period of an investment, fund or commodity. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Past performance is no guarantee of future results. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. The views and strategies described may not be suitable for all investors. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. In the years when the S&P did experience a double-digit decline, 13 of those 21 times-or 62% of the time-the market ended the year with a positive return. In every year, there was a market pullback and on average the market experienced a 13% decline. In 21 of the last 41 calendar years-more than half of the time-the S&P 500 saw a double-digit pullback within the year. From this, we can see how frequently at least one double-digit decline occurs within any given calendar year. This chart shows the maximum intra-year equity market drawdowns since 1980. But during a given year, significant drawdowns have been common. Both of these statements are true: Historically, the stock market’s general direction has been up.

0 kommentar(er)

0 kommentar(er)